Reading the L2 Pulse: Why Rollup Activity Matters

L2s as the New Crypto Heartbeat

If you want to catch big moves before they hit Crypto Twitter, Layer 2s are where you should be staring. Rollups like Arbitrum, Optimism, Base and zkSync are basically real‑time sentiment monitors for Ethereum: when users, devs and capital rush there, a new narrative is usually forming. Instead of guessing “what’s the next meta?”, you can read the L2 pulse directly on-chain and position yourself early. This is the core of front‑running narratives: following data, not influencers, and treating every spike in activity as a question worth investigating, not as a guaranteed signal to ape in.

Historical Background of L2 Rollups

From Ethereum Congestion to the L2 Race

The story starts with the 2020–2021 DeFi and NFT mania. Ethereum worked, but fees were brutal; small traders were effectively priced out. That pressure triggered a wave of scaling experiments: sidechains, plasma, state channels. Most of these were clunky or compromised on security. Rollups emerged as the pragmatic middle ground: keep Ethereum for settlement and security, move computation off‑chain. By 2022, rollups evolved from experiments into full ecosystems, and the market slowly realized that “scaling” wasn’t just infrastructure talk but also a way to unlock entirely new sets of users and use cases.

How Arbitrum, Optimism, Base and zkSync Took Shape

Arbitrum and Optimism were the early leaders in optimistic rollups, offering cheaper swaps while still anchoring to Ethereum. They attracted DeFi blue chips and retail yield hunters first. zkSync pushed the zk-rollup angle, promising stronger security guarantees and eventually native account abstraction, while Base arrived backed by Coinbase’s brand and fiat on‑ramps. Each chain grew with its own culture: Arbitrum for degen DeFi, Optimism for public goods and governance experiments, Base for consumer apps and memecoins, zkSync for zero‑knowledge tech enthusiasts. That divergence is exactly why it makes sense to compare arbitrum vs optimism vs base vs zksync which l2 to buy based not only on tech, but also on who is actually building and trading there.

Basic Principles of Front‑Running L2 Narratives

What a “Narrative” Really Is on L2

In plain language, a narrative is a story the market collectively decides to believe for a while: “L2 memes”, “restaking”, “points farming”, “perp DEX season”. On rollups this story shows up first as hard data: new wallets, rising TVL, fee spikes, new contracts getting hammered by users. Learning how to profit from layer 2 narrative crypto rollups starts with accepting that the story is downstream from behavior. Twitter threads and YouTube videos are lagging indicators; contract activity and bridge flows are leading ones. You’re not predicting the future; you’re just reading the shift in attention faster than most.

Key Metrics and On‑Chain Tools That Actually Matter

Most people overcomplicate analytics. You really need a small, consistent dashboard. Focus on: 1) daily active addresses per L2, 2) gas used and fee revenue, 3) bridge inflows and outflows, 4) new contracts gaining users quickly, and 5) L2‑native token volumes. Modern onchain analytics tools for tracking arbitrum optimism base zksync let you stitch these into a simple view: “Where is attention going this week?” Tools like Dune, Nansen, DeBank dashboards and custom bots can ping you when certain thresholds are hit, so you’re not doom‑scrolling charts all day but reacting only when data suggests a potential narrative inflection.

Practical Implementation and Real‑World Examples

Case Study: Incentive Waves and Airdrop Farming

Look at how incentive programs have driven past L2 booms. Arbitrum’s ecosystem exploded when people front‑ran the ARB airdrop by farming any DeFi app with traction. Optimism’s OP incentives created a wave of yield strategies that started on dashboards long before mainstream hype. zkSync Era and Base both saw early bursts in DEX and meme activity before narratives fully crystallized in media. Traders who were watching rollup activity noticed the uptick in new wallets and volume around specific dApps and bought related assets earlier. That’s the blueprint: tie on‑chain behavior to likely upcoming catalysts like tokens, fee sharing, or liquidity mining.

Building a Simple L2 Narrative Playbook

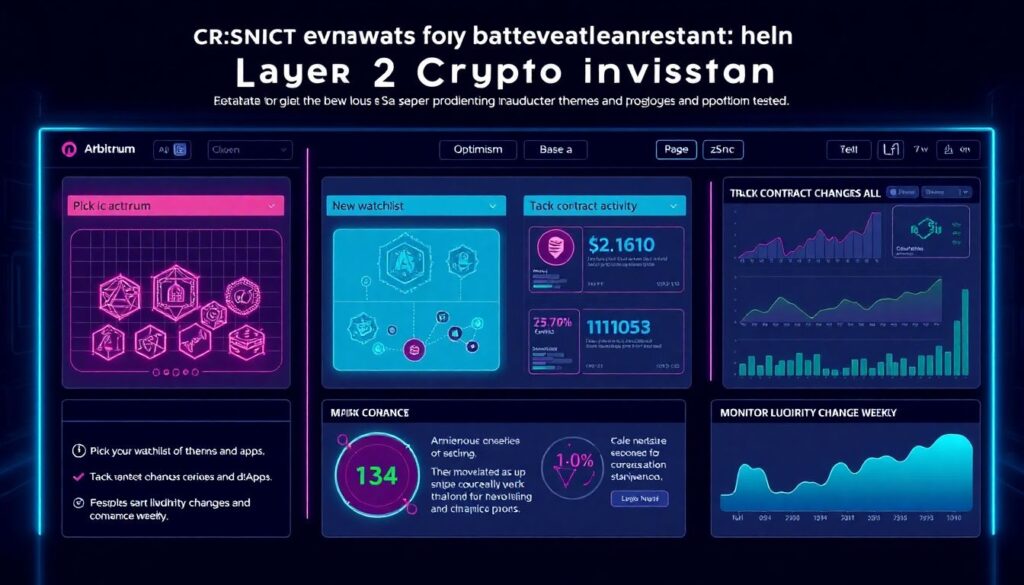

A practical way to approach the best layer 2 crypto to invest arbitrum optimism base zksync is to treat them as different “labs” where themes are tested. You can turn this into a repeatable process:

1. Pick your watchlist of chains and apps.

2. Track contract activity and liquidity changes weekly.

3. Flag dApps with sudden user and volume spikes.

4. Check if tokens exist or could launch.

5. Size small, enter early, exit into strength.

This is how you discover top l2 tokens to trade based on rollup activity: you’re not guessing which ticker will trend; you’re watching which product is already quietly winning users, and then positioning for when the broader market finally notices.

Common Misconceptions and Expert Recommendations

Myths About L2 Investing You Should Drop

A huge misconception is that there will be a single “winner” and everything else dies. In practice, each rollup optimizes for different audiences and business models, so liquidity and narratives rotate rather than converge. Another myth: higher TVL automatically means better upside. Often, the opposite is true—fat TVL with no real growth can signal a mature trade, not an opportunity. Also, watching bridges alone is not enough; experts emphasize combining user growth with app‑level stickiness, like repeat transactions and retention, not just one‑off farming spikes that unwind as soon as incentives fade.

What Experienced Traders Actually Do on L2s

Seasoned L2 traders treat these ecosystems like evolving laboratories, not slot machines. They compare arbitrum vs optimism vs base vs zksync which l2 to buy for a given theme instead of forcing one‑size‑fits‑all bets. Many keep a tiny “exploration stack” dedicated to new apps, accepting frequent small losses in exchange for catching occasional outsized winners. They also document every trade: why they entered based on rollup metrics, what they missed, and how the narrative unfolded publicly. The consistent advice from experts: master a few L2s deeply, automate your data feeds, don’t chase already viral trends, and let the rollup activity, not your emotions, tell you when it’s time to rotate.