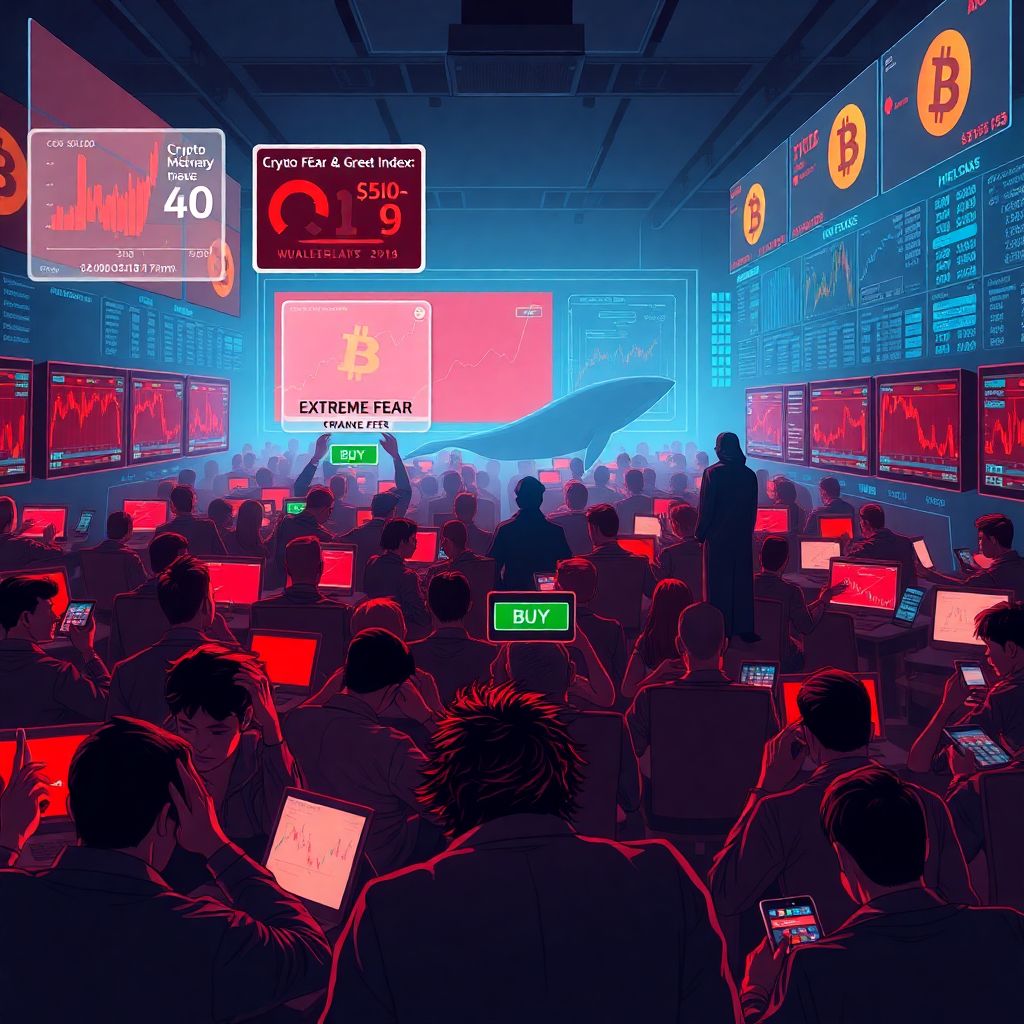

‘Extreme fear’ grips crypto: Is smart money buying while retail panics?

The crypto market is sending out a confusing mix of signals. On the charts, prices have started to stabilize after a sharp correction. Emotionally, however, the market is still deeply wounded. Just days after Bitcoin [BTC] briefly flirted with levels near $60,000, the asset managed a modest rebound – yet the mood among traders remains overwhelmingly negative.

On social platforms and in public discussions, pessimism dominates. Data from on‑chain and sentiment analytics firm Santiment shows that bearish commentary vastly outweighs bullish posts. Fear, doubt, and frustration are still the primary emotions driving conversations, even as prices attempt to claw back some of their recent losses.

This disconnect between price action and crowd psychology is not new. Historically, “extreme fear” phases have often laid the groundwork for powerful recoveries. When sentiment is this negative, many smaller or inexperienced investors are too scared to buy, preferring to wait for “clearer signals” that seldom arrive in time. In contrast, larger and more patient players – often referred to as whales or long‑term value investors – tend to become more active in such conditions.

Santiment’s charts highlight a familiar pattern: crowd sentiment and price often move in opposite directions at critical turning points. When optimism is euphoric and everyone feels invincible, markets are often closer to a top than most realize. Conversely, when fear becomes overwhelming and traders are convinced “it’s over,” prices frequently approach a bottom or at least a relief rally zone.

By analyzing social media tone, emotional keywords, and Bitcoin’s price movements, the data shows that extreme bullishness tends to cluster near local or macro peaks, while intense pessimism forms around major lows. One of the clearest examples in recent data emerged in February 2026, when Bitcoin plunged from nearly $100,000 down to the $60,000 range. This sharp move triggered a surge of fear‑driven posts, reflected in a prominent spike on Santiment’s sentiment chart.

These types of panic episodes often flush out “weak hands” – traders who entered late, over‑leveraged, or without a clear strategy. As they capitulate and sell at a loss, overall selling pressure can begin to subside. Once that forced selling slows, markets often gain the breathing room needed for a rebound. This is typically when longer‑horizon investors quietly step in, gradually accumulating positions at discounted prices and building the base for the next uptrend.

This approach echoes the famous principle associated with Warren Buffett: be fearful when others are greedy and greedy when others are fearful. Applied to the current crypto environment, the persistence of fear below the $70,000 mark for Bitcoin may not simply be a sign of weakness; it could also be the early stage of a new accumulation phase. If this interpretation is correct, today’s pessimism may turn out to be the fuel for tomorrow’s move higher.

At the same time, it would be misleading to suggest that a recovery is guaranteed or already underway. Technical indicators continue to paint a cautious picture. On 11 February 2026, the widely followed Crypto Fear and Greed Index plunged to 9 out of 100 – a reading categorized as “Extreme Fear,” and one of the lowest levels seen since the severe bear market of 2018. Such readings indicate that market participants are operating from a place of anxiety and risk aversion.

Broadly across major cryptocurrencies, the average Relative Strength Index (RSI) hovered near 39.79 around the same time. An RSI under 40 typically signals that many assets are oversold or under sustained selling pressure. Bitcoin itself has fallen more than 26% over the past month and is trading around $66,558, reflecting the depth of the recent correction despite the slight bounce from the lows.

Other technical tools, such as the Moving Average Convergence Divergence (MACD), continue to flash bearish or at best weak signals on higher timeframes. Downward momentum has slowed but not fully reversed, suggesting that the broader downtrend might still be intact. Until significant trend reversal patterns appear – such as higher highs and higher lows on daily and weekly charts – talk of a confirmed new bull leg remains speculative.

From a structural standpoint, the market also faces external headwinds. Selling from crypto‑related exchange‑traded funds (ETFs) has added an additional layer of supply, putting pressure on spot prices. For a durable recovery to take hold, this outbound flow likely needs to cool, while fresh capital must return to the spot market. Only when the balance between sellers and buyers shifts decisively in favor of demand can a sustained uptrend become more plausible.

Macro and regulatory factors should not be overlooked either. Global economic uncertainty, shifting interest rate expectations, tightening or loosening liquidity conditions, and evolving regulatory frameworks in major jurisdictions all influence risk appetite. Crypto, as one of the more speculative asset classes, is particularly sensitive to these shifts. As long as the broader environment remains unsettled, volatility is likely to remain elevated and confidence fragile.

So, are whales really accumulating in this climate of fear? On‑chain data often reveals a divergence between small and large holders during such phases. While retail wallets frequently show outflows or reduced activity, some larger addresses tend to increase their holdings when prices drop sharply. This behavior is consistent with a long‑term strategy: buying when assets are cheaper and sentiment is depressed, rather than chasing rallies driven by hype.

That said, accumulation by large players does not guarantee an immediate upward move. Whales can accumulate over weeks or months, and prices can remain under pressure, or even fall further, during that process. Markets can stay irrational longer than many traders can stay solvent, particularly those using high leverage. Extreme fear can persist, and attempting to “catch the bottom” with short‑term trades remains risky.

For individual investors, the key question is not just whether whales are buying, but what that means for their own strategy. Blindly following assumed whale activity is no substitute for a well‑defined plan. Instead, current conditions invite a more disciplined approach:

– Re‑evaluate risk tolerance and exposure sizes rather than reacting emotionally to price swings.

– Focus on time horizons: long‑term investors may view drawdowns differently than short‑term speculators.

– Use tools like RSI, volume, and market structure to inform entries, rather than relying solely on sentiment.

– Consider gradual accumulation strategies (such as dollar‑cost averaging) instead of all‑in bets at a single price level.

Another important angle is psychological. Extreme fear environments tend to amplify cognitive biases. Loss aversion pushes investors to lock in losses for emotional relief. Herd behavior encourages selling just because “everyone else is getting out.” Confirmation bias leads people to selectively search for negative news that supports a bearish view they already hold. Being aware of these mental traps can help traders avoid impulsive decisions that they may later regret.

On the flip side, ignoring risk in the name of being a contrarian can be just as dangerous. Buying simply because sentiment is bad, without considering macro context, liquidity, or technical breakdowns, is not a strategy – it is gambling. Healthy contrarianism involves weighing data objectively and acting when there is a clear mismatch between fear and fundamentals, not blindly doing the opposite of the crowd.

This market phase also raises a broader question: what signals are truly worth following? Price is the most direct signal, but it’s also the most widely watched and can be distorted by leverage, liquidations, or short‑term flows. Sentiment indicators reveal the emotional state of the crowd, which can be useful contrarian tools at extremes, but are poor timing mechanisms on their own. On‑chain metrics, such as the movement of long‑term holder coins, realized value, or accumulation trends, can provide deeper insight into whether capital is quietly positioning for the future.

Investors who can combine these layers – technicals, sentiment, on‑chain data, and macro context – are often better equipped to navigate turbulent conditions. They are less likely to be shaken out by single data points and more likely to recognize when fear is justified versus when it has swung too far.

For now, the crypto market sits in a zone of tension: prices are trying to stabilize, sentiment remains extremely fearful, and underlying indicators are mixed. This combination has historically preceded both major bottoms and prolonged periods of sideways consolidation. Whether this moment becomes a generational buying opportunity or just another pause in a deeper correction will depend on how the next waves of liquidity, regulation, and macro events unfold.

Until clearer signs of trend reversal emerge, the environment demands caution, patience, and rigorous risk management. Whales may indeed be quietly accumulating, but each investor must decide for themselves whether they are prepared – financially and emotionally – to endure further volatility if the market’s path to recovery proves longer and rougher than expected.

Disclaimer: This text is for informational purposes only and should not be taken as financial or investment advice. Cryptocurrency trading and investing involve high risk, and every participant should conduct independent research and consider their own financial situation before making any decisions.