ETH staking demand surges as entry queue nearly doubles exit line

Ethereum’s staking dynamics have flipped for the first time in half a year: more Ether is now waiting to enter the validator set than to leave it — and by a wide margin. Market participants are reading this as a strongly bullish signal for ETH.

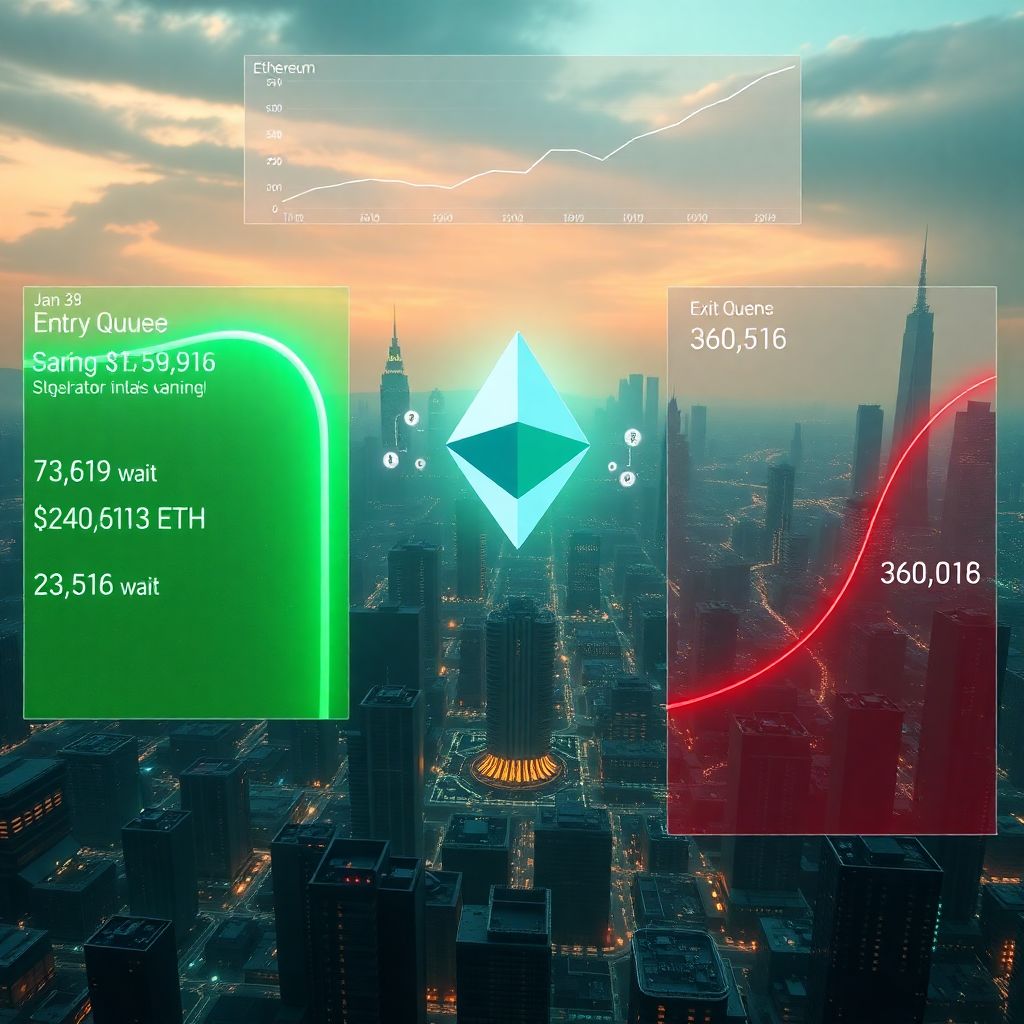

According to on-chain data, the validator entry queue currently holds around 745,619 ETH, implying a wait of nearly 13 days before new validators can begin proposing and attesting blocks. By contrast, the exit queue has shrunk to roughly 360,518 ETH, with an estimated eight-day delay for validators who want to stop participating and withdraw.

This reversal occurred on Saturday, when both the entry and exit queues hovered around 460,000 ETH each. Since then, the amount of Ether lining up to be staked has spiked sharply, while the exit queue has started to trend down, with some analysts projecting it could soon hit zero.

Abdul, head of DeFi at layer-1 blockchain Monad, highlighted on X that the last time Ethereum’s entry queue overtook the exit queue in June, ETH went on to double in price shortly afterward. Back then, Ether climbed above $2,800 in June and rallied to a new all‑time high of about $4,946 by Aug. 24. As of Monday, ETH is changing hands near $3,018.

Ethereum operates on a proof-of-stake (PoS) consensus model, where validators must lock up ETH to help secure the network. In this system, unstaking is often interpreted as potential sell pressure, since freed-up ETH can be moved to exchanges or redeployed elsewhere. Staking, on the other hand, is generally viewed as a vote of long‑term confidence, taking ETH out of liquid circulation in exchange for yield and participation in consensus.

In a Dec. 24 post, Abdul described the exit queue as a leading signal for predictable supply flows into the market. According to his analysis, Ethereum has been under persistent selling pressure since July, as unstaked ETH gradually made its way back into circulation. He estimated that around 5% of the total Ether supply has changed hands over that period, including the impact of a large-scale unstaking event from staking provider Kiln in September.

Abdul further claimed that about 70% of the ETH released through unstaking was absorbed by BitMine, a digital asset treasury company led by Tom Lee. By his calculation, BitMine now controls roughly 3.4% of the entire ETH supply, underscoring how aggressively some institutional and treasury-focused players have been accumulating and staking Ether.

Kiln, a major staking service provider, initiated what it described as an “orderly exit” of all its Ethereum validators in September. The move was taken as a precautionary safety measure following the exploit of the digital asset investment platform SwissBorg, with which it had exposure. That coordinated withdrawal significantly boosted the exit queue at the time, temporarily amplifying perceived sell pressure on ETH before much of that supply was reabsorbed.

“At its current rate, the validator exit queue will reach zero on Jan. 3 — after which I expect the sell pressure on ETH to subside,” Abdul wrote, suggesting that the structural overhang from unstaking could soon be largely cleared out.

Other market observers have attributed the reversal in staking queues to the aggressive accumulation and staking of Ether by large digital asset treasuries. Dylan Grabowski, host of the Smart Economy Podcast, pointed specifically to firms like BitMine, which have been rapidly converting idle ETH into staked positions.

On-chain analytics platform Lookonchain recently highlighted that BitMine staked 342,560 ETH in just two days, an amount worth roughly $1 billion at current prices. This kind of concentrated demand from a small number of large players can meaningfully tilt the balance of the staking queues in a short period of time.

Another factor potentially driving the surge in staking interest is Ethereum’s upcoming Pectra upgrade (often referred to in combination with Prague/Electra). The pseudonymous DeFi Creator Studio Pink Brains co-founder, Ignas, argued that expectations around Pectra have improved the staking user experience and made operations more flexible for large holders. In particular, raising maximum validator limits and smoothing infrastructure constraints could make restaking and large-scale validator management easier, encouraging institutions to commit more ETH to staking.

Ignas also suggested that DeFi deleveraging has played a role. As Aave borrowing rates increased, many users running leveraged strategies — especially so‑called stETH loopers who repeatedly borrowed against staked Ether — were forced to unwind positions. That unwinding may have freed up collateral and shifted ETH flows back into straightforward staking rather than leveraged yield strategies, contributing to the visible flip between the queues.

—

Why the staking queue flip matters for ETH

For long‑term Ethereum watchers, the switch from an exit-dominated environment to one where entry demand is stronger is more than just a technical curiosity. It touches directly on supply dynamics, market sentiment, and perceived risk.

1. Reduced net sell pressure

When more ETH is being staked than unstaked, the net amount of Ether exiting the validator set falls or even turns negative. That means less fresh supply is being unlocked and potentially sold on the market. If demand stays constant or increases, this can support prices or magnify upside moves.

2. Growing share of Ether locked in staking

As more validators join, a greater portion of ETH becomes illiquid, sitting in staking contracts rather than on exchanges. This constrains the freely tradable supply, which can make ETH more sensitive to demand shocks — in both directions, but especially on the upside if buying accelerates.

3. Signal of institutional confidence

The fact that treasury managers and professional asset allocators are willing to lock up large amounts of ETH for extended periods suggests they view Ethereum as a core long‑term asset, not just a speculative trade. Their time horizons and risk frameworks are typically more conservative than those of retail traders, so their behavior carries informational weight.

—

What this could mean heading into 2025–2026

Abdul’s remark that “2026 going to be a movie” reflects a broader narrative forming around Ethereum’s medium‑term outlook:

– Past instances where the entry queue overtook the exit queue have coincided with strong price performance over the following months.

– If the exit queue indeed trends to zero, the mechanical source of sell pressure from unstaking is largely removed, at least temporarily.

– Combined with structural factors like potential ETF demand, L2 growth, and Ethereum’s burn mechanism (EIP‑1559), the network could face a period where net new supply is limited while demand grows, a setup that historically has favored long‑term appreciation.

Of course, this is not a guarantee. Macro conditions, regulatory decisions, and technological risks can all disrupt the pattern. But pure on‑chain flows are currently tilting in a direction that aligns with a bullish multi‑year thesis.

—

How treasury buying shapes Ethereum’s market structure

The aggressive positioning by digital asset treasuries like BitMine marks an important structural shift:

– These entities tend to buy in size and hold for long horizons, often staking to earn yield rather than actively trading.

– By accumulating a meaningful share of total ETH supply, they consolidate ownership among actors who are less likely to panic‑sell on short‑term volatility.

– Their behavior can smooth out market cycles, but it also means that a growing amount of ETH is effectively “locked up” in semi‑permanent treasury allocations and staking pools.

If this trend continues, Ethereum’s market could start to resemble a hybrid between a growth tech asset and a yield‑bearing digital bond, where a large portion of supply is owned by institutions and treasuries, while the remaining float trades more aggressively on retail platforms and derivatives markets.

—

Staking risk–reward: what validators are signaling

The current queue configuration also reflects how validators are weighing rewards versus risks:

– Rewards: Stakers earn consensus rewards plus potential MEV (maximal extractable value), which, when combined, can produce an attractive real yield, especially in a low-rate or risk‑on environment.

– Risks: Validators face slashing risk, client bugs, regulatory uncertainty, and opportunity cost of locking ETH instead of using it for DeFi, trading, or real-world spending.

The fact that more ETH is lining up to enter than exit indicates that, for many sophisticated participants, the reward profile currently outweighs the perceived risks. Changes in these conditions — such as stricter regulations on staking services, major client vulnerabilities, or significantly higher yields in traditional finance — could alter this calculus in the future, but for now, the balance is clearly in favor of staking.

—

Implications for DeFi and restaking ecosystems

The flip in staking queues also intersects with the restaking and DeFi yield landscapes:

– If Pectra and other upgrades make validator management more scalable, large holders can operate or delegate many more validators, feeding the growth of restaking protocols and liquid restaked tokens.

– As more ETH is staked directly, competition for yield among DeFi strategies could intensify. Protocols may need to innovate on incentives, composability, and risk management to attract capital that might otherwise just flow into vanilla staking.

– Deleveraging episodes, like the one triggered by rising Aave borrow rates, remind participants that leveraged stETH loops and complex yield stacks can unwind violently. The current shift back toward simpler staking flows may represent a temporary risk‑off stance within DeFi, even as confidence in Ethereum itself grows.

—

What investors should watch next

For anyone tracking Ethereum’s macro trend, several on‑chain and fundamental metrics now look particularly important:

1. Size and direction of staking queues

– Does the entry queue stay elevated relative to the exit queue?

– Does the exit queue actually hit zero and remain low, confirming that the major wave of unstaking is behind the market?

2. Concentration of staked ETH

– How much ETH is being controlled by a handful of treasuries and staking providers?

– Are centralization risks increasing, or is staking participation diversifying over time?

3. Post‑Pectra user behavior

– Once Pectra goes live and UX improvements are felt, do we see another spike in staking?

– Do restaking and DeFi‑adjacent products capture a larger share of new ETH flows?

4. Macro and regulatory backdrop

– Interest rate changes, new ETF products, or regulatory clarity around staking services could all amplify or dampen the effects currently visible in the queues.

—

Bottom line

Ethereum’s validator entry queue suddenly dwarfing its exit queue marks a clear shift in network and market behavior. Significant amounts of ETH are being locked into staking, large treasuries are absorbing unstaked supply, and the structural sell pressure that weighed on the asset since mid‑2024 appears to be easing.

While no single metric can predict price with certainty, the combination of shrinking exit flows, rising institutional staking, and upcoming protocol upgrades paints a picture of a network entering a new phase of maturity and capital commitment. For now, the validators are voting with their ETH — and they are voting to stay in.