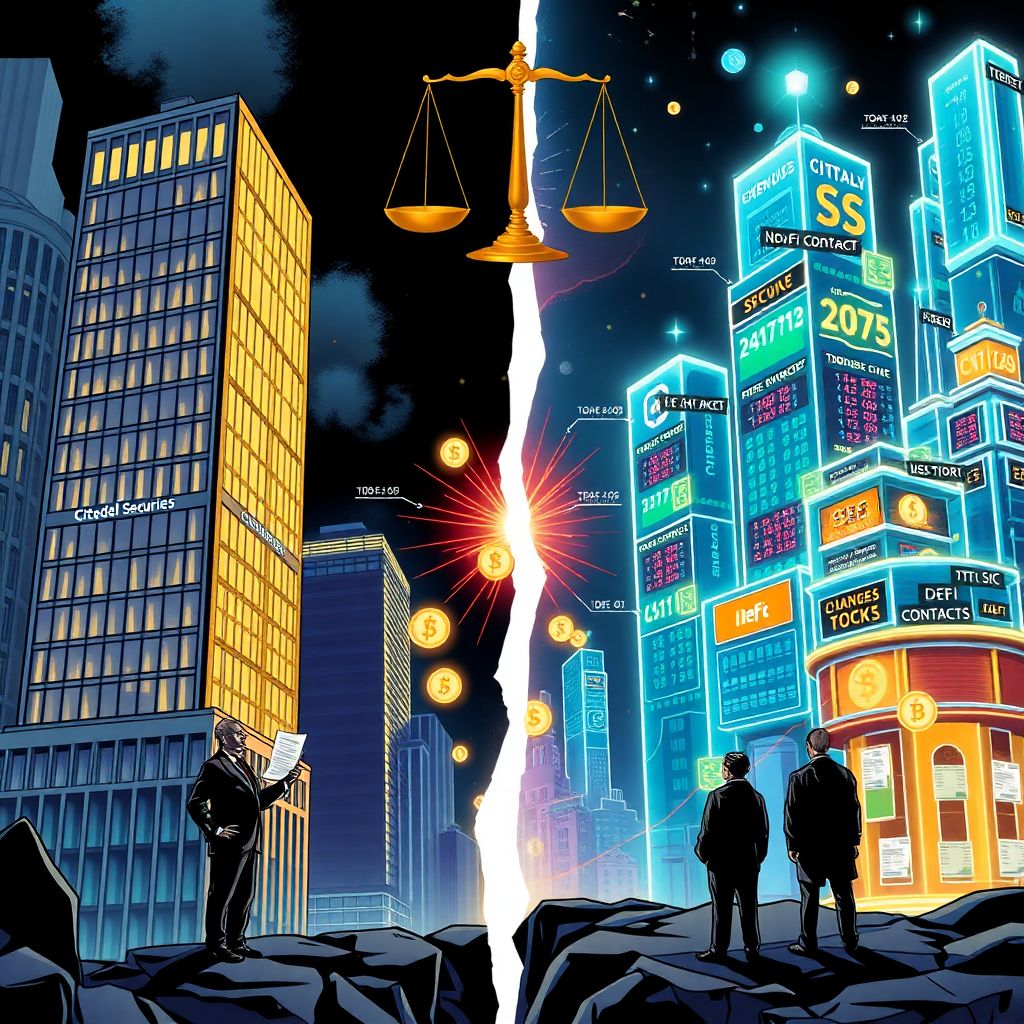

Citadel slammed for calling on SEC to crack down on DeFi tokenized stocks

Citadel Securities has ignited a storm in the crypto industry after urging the United States Securities and Exchange Commission (SEC) to apply full securities regulation to decentralized finance (DeFi) platforms that list or trade tokenized US stocks.

In a detailed letter to the SEC, the high-frequency market maker argued that DeFi protocols offering tokenized shares of US companies should not receive broad exemptions or special treatment. Instead, Citadel claimed these platforms fit neatly within existing legal definitions of an “exchange” or “broker-dealer” and must therefore comply with long‑standing securities laws.

According to Citadel, allowing tokenized versions of the same stock to trade in a lighter regulatory environment would split the market into two incompatible frameworks. The firm warned that this would effectively create a “dual regime” for identical securities, undermining the “technology-neutral” principle that underpins the Exchange Act, where the same rules should apply regardless of whether trading happens via traditional venues or blockchain-based systems.

The firm’s intervention came in response to an SEC request for feedback on how tokenized stocks should be overseen. Rather than asking the regulator to modernize or adapt its framework, Citadel pressed for a strict application of existing rules, specifically objecting to any “broad exemptive relief” for DeFi developers, smart contract authors, or providers of self-custody wallets involved in tokenized equity trading.

Citadel’s stance quickly triggered an intense backlash among crypto advocates and DeFi builders who view such recommendations as an attack on open, permissionless innovation. Critics argue that equating software developers and protocol coders with traditional financial intermediaries stretches securities law far beyond its original intent and risks stifling a nascent technological frontier.

Prominent industry lawyers pushed back, suggesting it was unsurprising that an entrenched TradFi market maker would oppose systems designed to reduce dependency on centralized middlemen. From this perspective, Citadel’s call for tougher rules is seen not as a neutral concern for investor protection, but as an attempt to defend an existing business model against software-driven disintermediation.

Uniswap founder Hayden Adams added fuel to the criticism, remarking that it was entirely predictable that a dominant, opaque market-making firm would be uncomfortable with open-source, peer-to-peer infrastructure that lowers barriers for liquidity providers and traders. In his view, DeFi challenges the privilege of a handful of large firms to control market access, spreads, and execution quality.

Leaders of blockchain advocacy organizations were equally blunt. They argued that treating protocol engineers and wallet developers as if they were broker-dealers or exchanges themselves would erode US competitiveness in financial technology. Instead of protecting investors, they warned, overly broad regulation could push innovation and capital to more welcoming jurisdictions, leaving the US on the sidelines of the next wave of financial infrastructure.

These groups urged the SEC to focus on actual intermediaries that directly handle user assets or execute trades on behalf of clients, rather than those who merely write and publish code. In their view, regulation should be activity-based and proportionate to the risks posed, not status-based or driven by legacy players’ fears of disruption.

Citadel, for its part, framed its argument as a defense of consistency and investor protection. In an earlier letter to the SEC’s Crypto Task Force, the firm insisted that tokenized securities should succeed by demonstrating tangible improvements in market efficiency and user experience, not by exploiting what it called “self-serving regulatory arbitrage.” To Citadel, any perception that tokenized stocks are an easy way to bypass safeguards designed over decades would be a red flag.

The Securities Industry and Financial Markets Association (SIFMA), representing traditional financial institutions, echoed much of Citadel’s position. While SIFMA acknowledged that tokenization can introduce efficiencies—such as faster settlement and more transparent ownership records—it stressed that these innovations should sit atop proven investor protections, not replace them.

Pointing to recent episodes of extreme volatility and technical failures in crypto markets, including flash crashes and liquidity gaps, SIFMA described them as reminders of why robust regulatory frameworks were developed in the first place. In its view, the lessons of past crises should not be forgotten simply because trading is happening on a blockchain rather than a legacy exchange.

SIFMA has consistently opposed granting broad exemptive relief to DeFi or blockchain platforms that issue or trade tokenized assets. The association maintains that the same core principles—fair access, disclosure, market integrity, and investor protection—must hold whether a security is represented by a traditional share certificate or a token on a public ledger.

Citadel and SIFMA are not alone. The World Federation of Exchanges, which represents major stock exchanges around the globe, previously urged the SEC to walk back ideas of an “innovation exemption” for crypto companies looking to offer tokenized stocks. From their perspective, carving out a looser regime for digital-native platforms risks fragmenting markets and eroding trust in public markets overall.

At the heart of the dispute lies a fundamental question: is tokenization merely a new wrapper around existing financial products, or does it justify an entirely different regulatory paradigm? Citadel and allied TradFi institutions argue the former; many in the crypto sector insist it is the latter, at least for protocols that function without centralized control.

DeFi proponents emphasize the distinction between custodial and non-custodial systems. In their view, a smart contract that automatically matches and settles trades without collecting user funds or exercising discretion is closer to open-source infrastructure than to a broker or exchange. They argue that regulating code as if it were a Wall Street institution misunderstands both the technology and its threat model.

On the other side, regulators and legacy firms counter that if a platform walks, talks, and trades like an exchange—facilitating the buying and selling of regulated securities—it should not be able to sidestep supervision merely because its order book is written in Solidity and distributed across a network of nodes. For them, function matters more than form.

The debate also raises practical enforcement challenges. If a DeFi protocol is governed by a decentralized autonomous organization (DAO), with governance tokens scattered across thousands of holders worldwide, who is responsible for complying with SEC rules? Developers who launched the project? Front-end operators? Governance token holders? Critics of Citadel say these questions show why a direct transplant of TradFi rules may not work. Supporters respond that new models of accountability can be built without abandoning core protections.

Tokenized stocks themselves sit in a gray area that intensifies these tensions. Many of them purport to represent claims on real-world shares held by a custodian. Others mimic price exposure synthetically, relying on derivatives or oracles rather than direct ownership. For regulators, each model may trigger different obligations concerning disclosure, registration, and custody.

From an investor’s perspective, the appeal of tokenized equities is clear: 24/7 trading, global access, fractional ownership, composability with other DeFi products, and potentially lower fees. But these benefits come with risks, including smart contract bugs, unclear legal recourse, counterparty risk from off-chain custodians, and regulatory uncertainty if authorities later deem certain structures noncompliant.

Going forward, the SEC’s response to Citadel’s recommendations will signal how it intends to balance that trade-off. A hard-line stance—treating most tokenized stock platforms as fully regulated exchanges or broker-dealers—could push many projects offshore or into more permissionless, harder-to-regulate forms. A more nuanced approach—focusing on clear consumer-facing intermediaries and giving room for non-custodial protocols—might allow innovation to continue while addressing the most significant risks.

For tokenization projects, this controversy is a wake-up call. Teams building tokenized equity products will increasingly need to design with regulation in mind: clarifying custody arrangements, identifying responsible entities, building transparent disclosures into user interfaces, and considering geofencing or other mechanisms if certain jurisdictions become too restrictive.

Institutional players exploring tokenization also face strategic choices. Some may align with Citadel and SIFMA, using permissioned blockchains and tightly controlled networks that fit cleanly into current rules. Others may experiment with hybrid models, combining centralized compliance layers with decentralized settlement to capture some of DeFi’s efficiency without fully embracing its open architecture.

Ultimately, the clash between Citadel and the DeFi community reflects a broader question about who will shape the future of capital markets: incumbents adapting existing rules to new tools, or open-source builders attempting to reinvent market structure from the ground up. The SEC’s approach to tokenized stocks will be an early test case of that power struggle—and its outcome will influence how, where, and by whom tokenized securities are built and traded in the years ahead.