Bittensor (TAO) Poised for Breakout as Rally Challenges Key Resistance – Will Momentum Sustain?

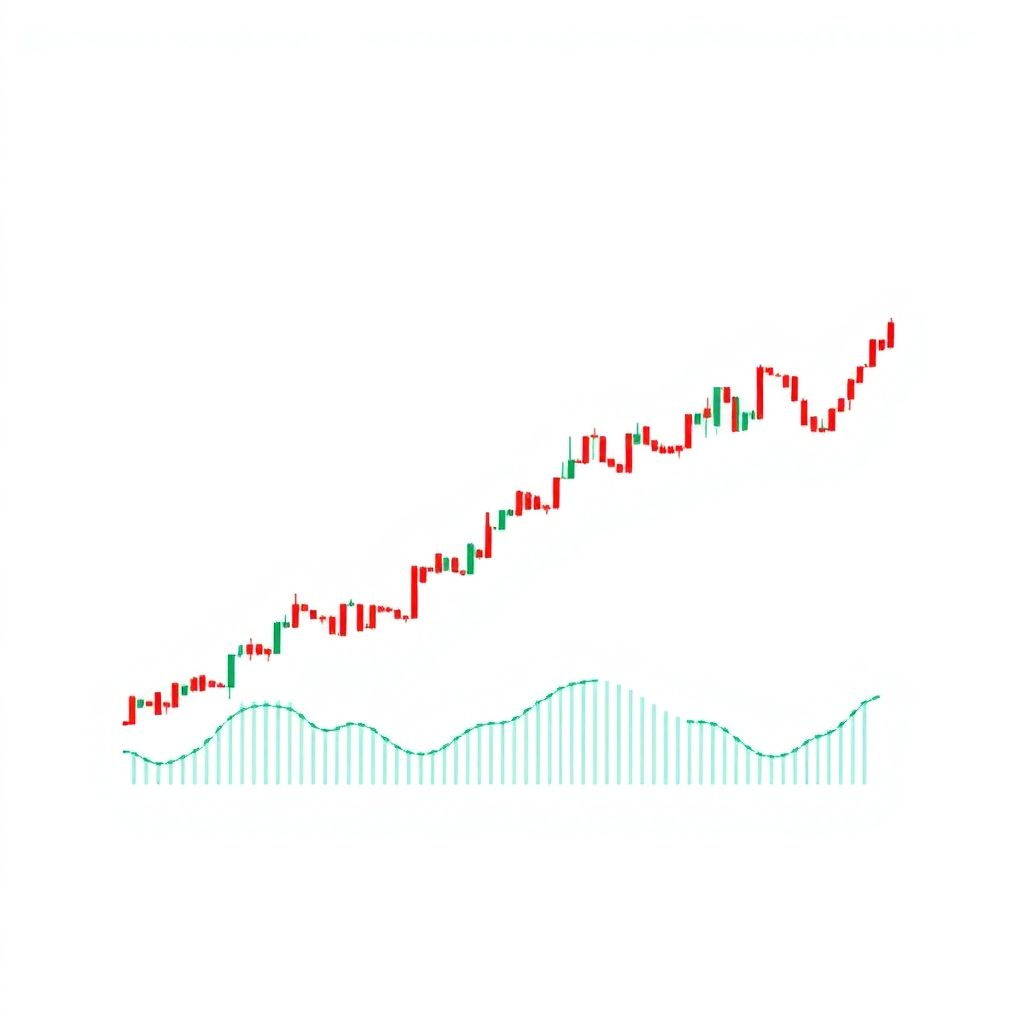

Bittensor (TAO) has shown remarkable strength in its recent price movement, rebounding sharply from the broader market downturn earlier this month. The token’s recovery has reignited optimism among bullish investors, as it now tests the upper boundary of a long-standing trading range—raising the possibility of a breakout if current momentum is sustained.

Since June, TAO has been confined within a horizontal channel, fluctuating between $295 at the lower bound and $471 at the top, with the midpoint around $383 serving as a pivot level. Despite the sharp sell-off on October 10, which briefly dragged TAO down to the $290 mark, the price never decisively broke below this established range. Notably, the daily candlestick on that day closed at $290.7, indicating strong buying support near the range floor.

This resilience proved to be a bullish signal. Over the past 24 hours, TAO surged by 10.75%, accompanied by a 38.8% jump in daily trading volume—an indicator of renewed investor interest. On the daily chart, TAO is now approaching the mid-range resistance at $383, with $471 looming as the next critical barrier. Should it break above this level, the token could unlock further gains, possibly targeting $500 and beyond.

Supporting this bullish outlook is the Chaikin Money Flow (CMF), which remains above +0.05, highlighting sustained capital inflows. The Relative Strength Index (RSI) also sits at 62, reflecting robust upward momentum without entering overbought territory.

A closer look at the TAO/USDT liquidation heatmap over a two-week period reveals a dense concentration of liquidation levels between $450 and $480. This liquidity cluster acts as a magnet for price action, suggesting that TAO is likely to gravitate toward or slightly beyond the top of its current range before encountering significant resistance. By contrast, the next comparable liquidity pool lies far below, near $395, making a downward move less probable in the short term.

Meanwhile, the TAO/BTC trading pair offers additional bullish confirmation. Following the market correction, TAO displayed a notable divergence from Bitcoin’s weaker performance. On October 12, it broke a key structural resistance level against BTC, signaling strength independent of Bitcoin’s trajectory. While BTC struggled to stabilize, TAO saw aggressive accumulation, suggesting investors are increasingly viewing it as a high-potential asset with relative strength.

This divergence is especially critical, as TAO has managed to outperform BTC during a period of market instability—a clear indication of its growing appeal. The long-term resistance levels on the TAO/BTC chart, last tested in early 2025, remain well above the current price, further reinforcing the possibility for continued upside.

What Could Fuel a Breakout Beyond $500?

Several factors could contribute to a sustained breakout above the $471-$480 resistance zone. Chief among them is the consistent rise in spot trading volume, which indicates genuine organic interest rather than speculative spikes. If this volume continues to grow, it would provide the necessary liquidity to support a move beyond the current range.

Another key driver is the increasing adoption and narrative around AI-based blockchain platforms. As Bittensor positions itself as a leading decentralized AI network, its native token TAO could benefit from macro-level trends in both AI and Web3. This thematic alignment makes TAO particularly attractive to long-term investors seeking exposure to emerging technologies.

Moreover, the broader crypto market sentiment is showing early signs of recovery. If Bitcoin and other major assets regain traction, altcoins like TAO that have already demonstrated independent strength could see amplified gains. A rising tide may lift all boats, but TAO appears ready to surge ahead of the pack.

Technical Outlook: Short-Term and Long-Term Projections

In the short term, a clean break above $471 would likely trigger a wave of stop-loss orders and short liquidations, potentially propelling TAO toward the psychological $500 mark. Beyond this, Fibonacci extension levels suggest secondary targets around $525 and $550, assuming the rally retains momentum.

Over a longer horizon, TAO’s ability to hold above the mid-range support at $383 will be critical. A successful retest of this level following a breakout could establish it as a new base, paving the way for further appreciation. Conversely, failure to sustain above this level may result in a return to the trading range and renewed consolidation.

Investor Sentiment and Risk Considerations

While the technical indicators and price structure appear bullish, investors should remain cautious. The crypto market remains volatile, and sudden shifts in macroeconomic or regulatory conditions can reverse trends quickly. As such, sound risk management and realistic profit targets are essential for those looking to capitalize on TAO’s current momentum.

Nevertheless, the combination of strong relative strength, increasing volume, and supportive technical indicators makes TAO one of the more compelling altcoins in the market currently. If buyers can maintain pressure and breach the $471 resistance convincingly, the road to $500—and potentially beyond—could open up in the near future.

Final Thoughts

Bittensor’s recent price action has transformed it from a consolidating asset into a potential breakout candidate. Its resilience during market downturns, increasing market share relative to Bitcoin, and growing investor interest all point toward a promising trajectory. While the next few days will be crucial in confirming whether a breakout is imminent, the underlying signals suggest that TAO is more than ready to test new highs—providing bulls can sustain the momentum.

As always in crypto trading, keeping an eye on volume, resistance levels, and broader market sentiment will be key in determining whether Bittensor’s breakout narrative becomes reality or remains just another failed test of range highs. But for now, all eyes remain on the $471 barrier—where the next chapter of TAO’s journey will be written.